Boros: Swallowing DeFi, CeFi, and TradFi to Unlock Pendle's Next 100x Growth Engine

With the release of Boros 1.0, the launch of the referral program, and the introduction of more markets, Boros' devouring of the yield world may be officially unfolding through funding rates.

If you were to choose the most innovative DeFi protocol, who would you nominate?

Pendle would surely be on the list.

In 2021, Pendle became the first DeFi protocol to focus on the "interest rate swap" market, single-handedly opening up a yield trading market worth billions and becoming the absolute leader in the yield trading track.

And in August 2025, Pendle's pioneering spirit of innovation continued with the launch of Boros, opening up the on-chain yield blind spot of "funding rates," and for the first time bringing trading, hedging, and arbitrage opportunities for funding rates to the DeFi world, once again sparking public discussion and a wave of participation.

According to the latest data from Pendle, as of now, Boros has been online for two months, with a cumulative notional trading volume exceeding $950 million, open interest exceeding $61.1 million, user numbers surpassing 11,000+, and annualized revenue over $730,000.

In just one month, it has already achieved what many projects take years to accomplish. Meanwhile, many participants excitedly claim: Playing with Boros' yield space can even be more lucrative than Meme coins.

So, what is Boros? How do you play it? What are the future plans?

Many people have noticed that Boros' brand visuals often feature a giant whale devouring everything, and the word Boros in ancient Greek also means "to devour." With the release of Boros 1.0, the launch of the referral program, and the introduction of more markets, Boros' devouring of the yield world may be officially unfolding through funding rates.

As a structured interest rate derivatives platform, Boros currently focuses on funding rates, aiming to turn funding rates into tradable standardized assets.

Most contract users are no strangers to funding rates. It acts like an "invisible hand" in the contract market, balancing perpetual contract prices with spot prices. Its specific operation logic can be simply understood as:

-

When the funding rate is positive, it means most people expect prices to rise, longs are dominant, contract prices are higher than spot prices, and longs must pay funding rates to shorts, curbing excessive market optimism.

-

When the funding rate is negative, it means most people expect prices to fall, shorts are dominant, contract prices are lower than spot prices, and shorts must pay funding rates to longs, curbing excessive market pessimism.

As a key to balancing long and short forces, the funding rate is also a crucial indicator reflecting market sentiment.

Before Boros, traders passively accepted the regulation of the market by funding rates, never imagining that one day funding rates could become a tradable asset in their own right.

So, why did Boros choose funding rates as the first shot to build its product reputation?

Large scale, high volatility, and high returns—these characteristics unique to funding rates are the fundamental reasons why Pendle believes it has great potential.

- Large scale:

The contract market is already much larger than the spot market, and once the contract market is running, funding rates flow continuously.

According to a CoinGlass report, the total perpetual contract trading volume in Q2 2025 reached $12 trillion, with a daily average trading volume of about $130 billion; and according to most exchanges' 0.01% / 8-hour settlement rule, the daily funding rate market size easily exceeds tens of millions, and can even surpass hundreds of millions in extreme market conditions.

If this huge and stable market of funding rates can be better utilized, it will surely give birth to the next heavyweight financial innovation.

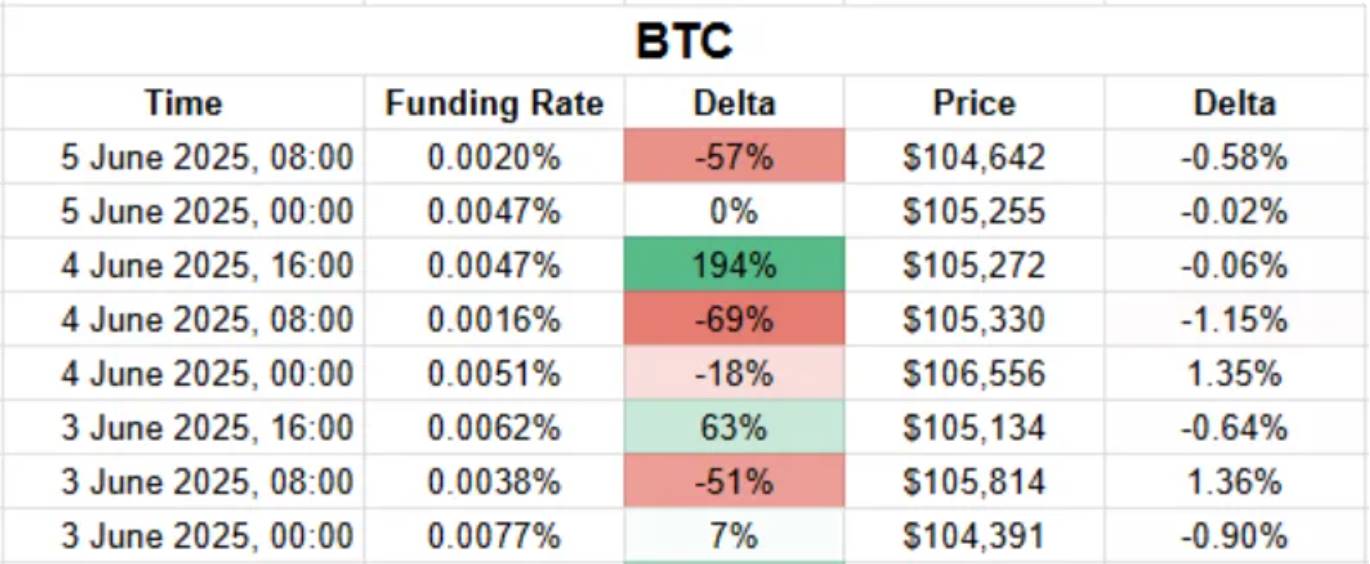

- High volatility:

In the spot market, a token's sharp rise or fall in a day quickly becomes a hot topic, but this is the norm in the funding rate market.

For example: According to Coinmarketcap data, on September 8, 2025, MYX Finance (MYX) rose over 168.00%, topping the list of the top 100 cryptocurrencies by market cap, and quickly became a hot topic in the market. In the tug-of-war between longs and shorts, funding rates themselves are constantly fluctuating, especially for many altcoins, where funding rate volatility can reach four or five times or even more. For example, with $TRUMP, some traders have paid annualized funding rates as high as 20,000% to maintain long positions.

Taming the wild beast of funding rates not only helps users better formulate trading strategies but also hides huge profit opportunities.

- High returns:

The core logic is: volatility creates excellent opportunities for profit.

With volatility, there is room for buying low and selling high. The highly volatile funding rate market can also become an important way for users to capture profit opportunities.

How to turn funding rates into a standardized asset to enable trading, profit, hedging, arbitrage, and other strategies is a huge test of product design skills.

Betting on the Future Rise and Fall of Funding Rates: How Does Boros Achieve This?

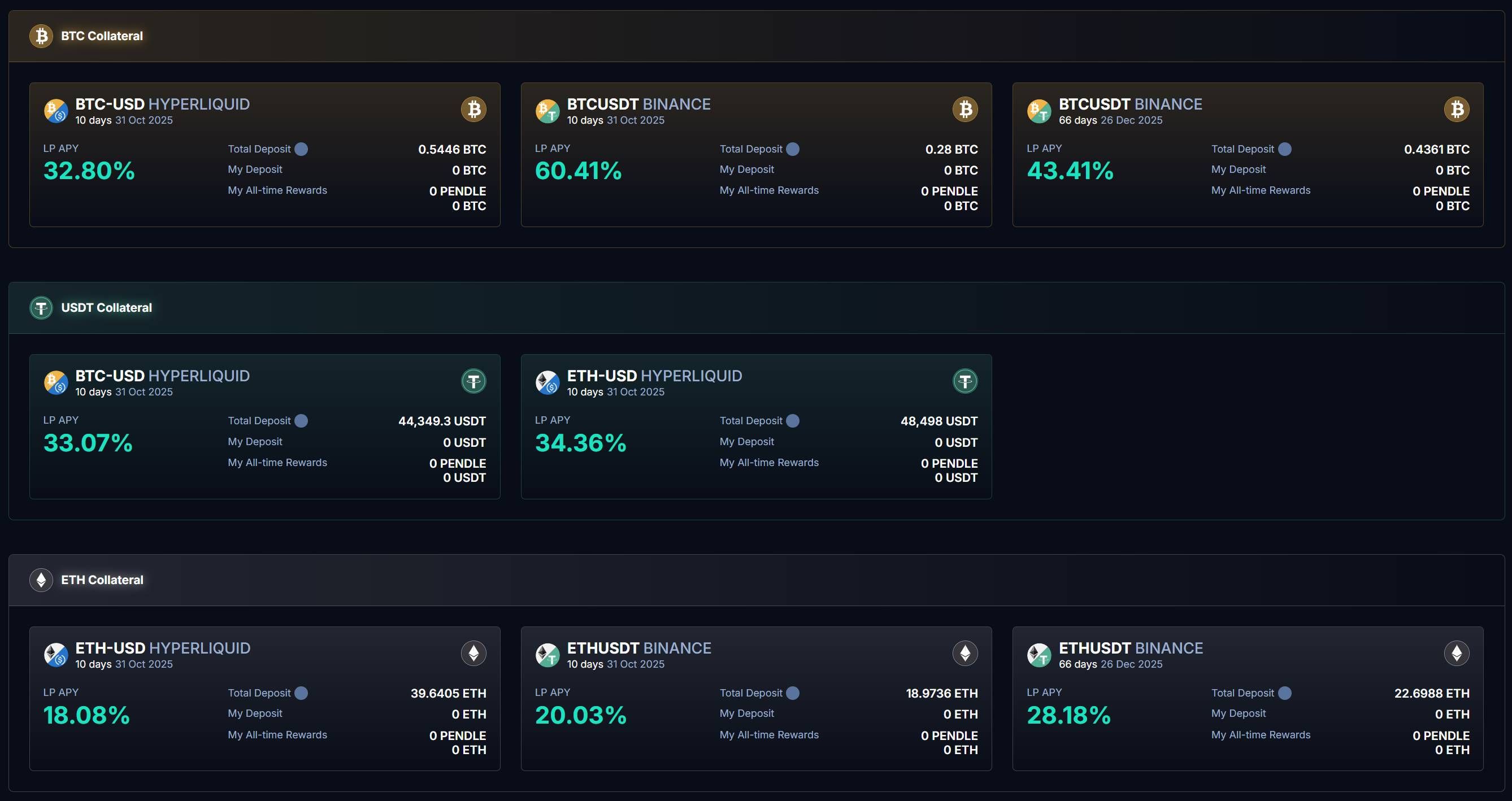

On the Boros page, Boros has already launched multiple markets for BTC, ETH, and USDT on Binance and Hyperliquid:

As mentioned above, funding rates are a key indicator of market sentiment. In other words, if you can accurately sense market sentiment, you can profit from funding rate trading on Boros.

So how do you turn this market prediction into tangible profit?

The core of Boros is to lock in the current market funding rate and, based on this, provide users with betting options: if the future rate rises, those who are bullish profit; if the future rate falls, those who are bearish profit.

This is all achieved through YU.

Users can connect their wallets to deposit, provide collateral, and purchase YU.

YU is the core means of turning funding rates into a standardized asset, representing the right to the funding rate income over a future period. At the same time, YU is the smallest trading unit after quantifying the funding rate. For example, for "BTCUSDT Binance," purchasing 1 YU BTCUSDT Binance represents the funding rate income for a 1 BTC position on Binance's BTCUSDT.

We know that profit = income - cost. The calculation of YU's profit relies on three core data points: Implied APR, Fixed APR, and Underlying APR.

Buying YU is equivalent to opening a position, which involves two cost components:

On one hand, Implied APR is the rate locked in at the time of opening the position, which can be seen as the price of YU and serves as the fixed annualized rate before maturity. Implied APR is a benchmark for measuring future changes in market funding rates, representing the fixed annualized funding rate over a future period;

On the other hand, opening a position incurs transaction fees. This fee, combined with the Implied APR, forms the Fixed APR, which is the cost of opening the position.

Once the cost is clear, the next step is to calculate income.

Through YU, we have locked in a funding rate, while the actual funding rate on external exchanges is represented by the Underlying APR.

When purchasing YU, we have two options to go long or short on the funding rate:

-

Buy Long YU (long funding rate): During the term, the user pays Implied APR and receives Underlying APR

-

Buy Short YU (short funding rate): During the term, the user pays Underlying APR and receives Implied APR

At this point, profit lies in the difference between income and cost, that is, the difference between Fixed APR and Underlying APR.

-

When Fixed APR < Underlying APR, i.e., when the market floating rate is higher than the fixed rate, Long YU users profit

-

When Fixed APR > Underlying APR, i.e., when the market floating rate is higher than the fixed rate, Short YU users profit

This leads to:

-

Long funding rate: buy Long YU

-

Short funding rate: buy Short YU

In terms of profit settlement, Boros synchronizes with the settlement cycle of perpetual contract trading platforms.

Take the currently launched BTCUSDT Binance product as an example: Binance's funding rate is settled every 8 hours, and Boros' BTCUSDT Binance trading pair is also settled every 8 hours.

At each settlement, Boros calculates the difference between Fixed APR and Underlying APR for settlement:

-

When Fixed APR < Underlying APR: collateral is deducted from Short YU, and profits are distributed to Long YU users.

-

When Fixed APR > Underlying APR: collateral is deducted from Long YU, and profits are distributed to Short YU users.

We know that YU represents the right to funding rate income over a future period, and this right is settled according to exchange rules every 8 hours (or 1 hour). In other words, the value of YU decreases with each settlement, and after maturity, as it no longer predicts the rate, YU completes its mission and goes to zero.

Of course, to leverage greater profit opportunities, **Boros also provides up to 3x leverage tools,** allowing users to open larger positions with less collateral. However, high leverage also comes with greater liquidation risk, so users need to regularly monitor their health factor and adjust collateral in time to avoid liquidation.

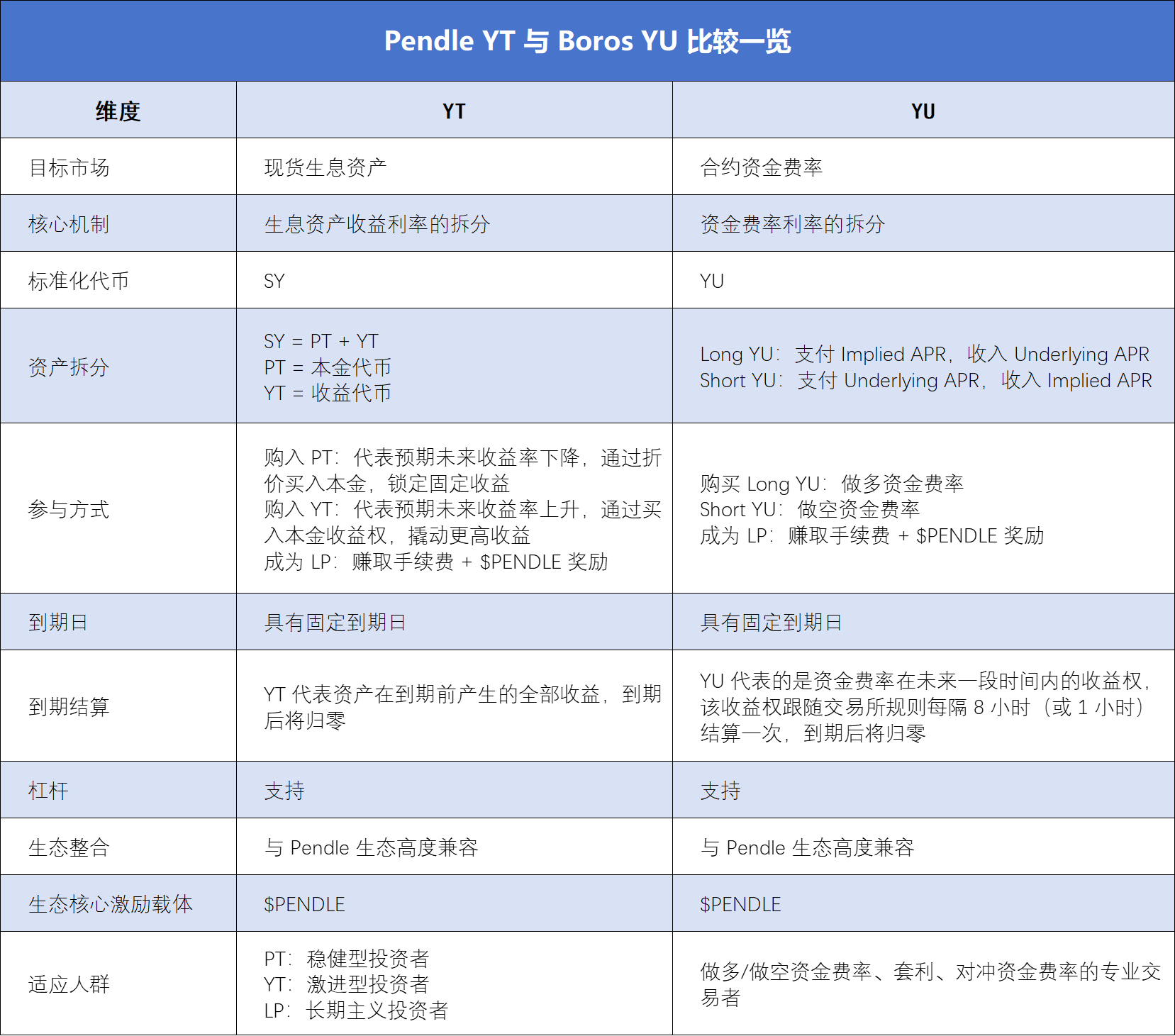

For those familiar with Pendle YT rules, there are indeed many similarities between YT and YU, which can help users better understand YU. However, there are also significant differences in essence, which can be clarified through the table below:

From Hedging to Arbitrage: Boros Becomes a Tool for Traders to Reduce Costs and Increase Efficiency

Based on this long/short funding rate gameplay, Boros has sparked spontaneous discussions among contract traders, institutions, and professional DeFi players since its launch, actively exploring Boros' ingenious uses in many practical scenarios.

The most direct way to participate is to buy YU and bet on the rise and fall of funding rates:

By choosing between Long YU and Short YU, users earn the difference between fixed and floating rates. On September 12, 2025, Boros launched the Hyperliquid funding rate trading market. Compared to Binance, Hyperliquid's funding rate is more volatile, providing users with even more exciting long/short battles.

**For long-term position holders, Boros' greater utility lies in funding rate hedging in highly volatile environments:** On Boros, take the opposite rate strategy to your CEX perp position to offset the risk of floating rate volatility, thereby locking in cost/profit as a fixed value.

For example, if a user holds a perp long position on CEX and pays a floating rate, they can buy Long YU on Boros, and the floating rate paid on CEX is offset by the floating rate income from Boros;

Conversely, if a user holds a perp short position on CEX and pays a floating rate, they can buy Short YU on Boros, and the floating rate paid on CEX is offset by the fixed rate income from Boros.

In this way, the risk and cost of contract trading become more controllable, which is very attractive to traders, especially institutional traders. A very intuitive case is Ethena: as one of the representative projects of delta-neutral strategies, Ethena's income mainly comes from positive funding rates. Therefore, when funding rates fluctuate sharply, Ethena also faces huge income uncertainty, even affecting the project's sustainability.

Through Boros protocol's YU, Ethena can lock in a fixed rate on-chain, achieving predictable returns and thus improving the protocol's profitability and efficiency.

Meanwhile, the launch of the Hyperliquid market also unlocks new cross-exchange arbitrage opportunities for users:

The essence of arbitrage is price differences in different markets. Currently, among the two major trading platforms supported by Boros, Binance has more large institutions and uses an 8-hour settlement cycle, making funding rates relatively stable, while Hyperliquid has more retail users, settles every hour, and has faster capital flows and greater funding rate volatility, creating more space for cross-exchange arbitrage.

In addition to cross-exchange arbitrage, Boros currently offers multiple products with different expiry dates, allowing traders to engage in cross-term arbitrage: if the Implied APR of the earlier-maturing YU is lower than that of the later-maturing YU, it indicates the market expects short-term rates to be lower and long-term rates to be higher. You can buy the earlier-maturing YU and sell the later-maturing YU, and vice versa.

Of course, if you are not good at long/short speculation, you can also choose to become an LP:

Boros allows users to become LPs by depositing funds through the Vaults mechanism, providing liquidity for YU trading and earning swap fees and $PENDLE rewards. On the Boros Vaults page, we can see the Vaults APY for BTCUSDT Binance is as high as 60.41%.

However, it should be noted that since Boros' Vaults mechanism is similar to Uniswap V2, LP positions are essentially a combination of "YU + collateral" and are affected by Implied APR. Therefore, being an LP is also considered a mild long YU position, and when Implied APR falls, users may face the risk of high impermanent loss.

Additionally, due to Boros' high popularity, Vaults quotas have become more sought after. However, as Boros moves from a soft launch to rapid development, Vaults quotas will gradually increase in the future.

All Resources Return to Pendle: Referral Program Opens the Next Round of Rapid Growth

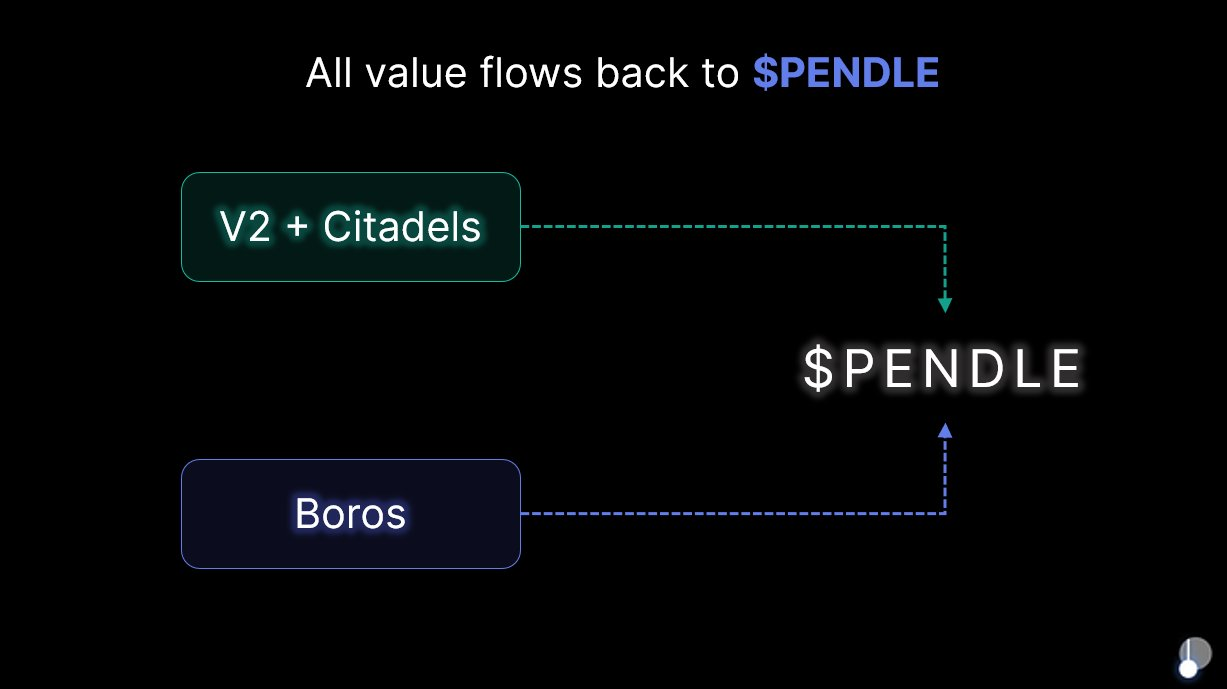

As the core product in Pendle's 2025 roadmap, Boros not only plays a key role in the Pendle ecosystem but also significantly drives Pendle's overall development through innovative mechanisms and market expansion.

Pendle's ultimate vision is to be an "all-in-one yield trading gateway." Boros not only continues Pendle's innovation in yield tokenization but also, for the first time, opens up the high-scale, high-volatility market of funding rates, turning CEX and DEX funding rate tokens into standardized assets (YU), expanding Pendle's ecosystem from on-chain DeFi to off-chain CeFi.

In addition, when Boros officially announced the launch of version 1.0, it clearly stated that **no new tokens will be issued after Boros goes live, and protocol-generated revenue will continue to flow back to $PENDLE and $vePENDLE, further ensuring that $PENDLE will be the ultimate beneficiary of all value created by Pendle V2 and Boros.** Meanwhile, on August 6, 2025, after Boros was released, $PENDLE surged over 40% within the week, validating the market's recognition of Boros' potential.

Truly game-changing innovation often comes from rediscovering "long-ignored value," and Boros' focus on funding rates reveals a treasure trove that has long been hidden behind the perpetual contract market—huge in scale but yet to be fully tapped.

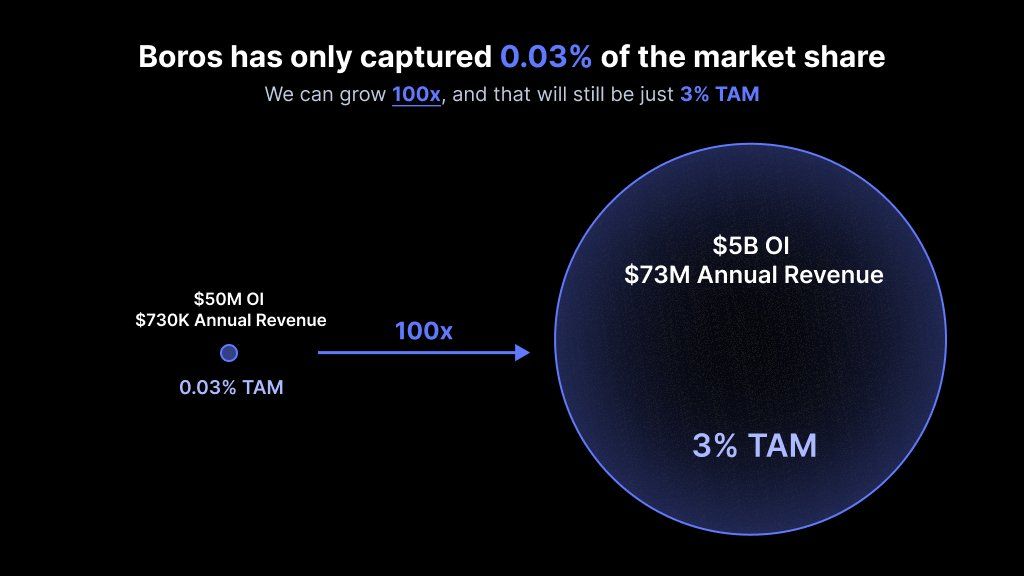

Currently, the perpetual contract market has over $200 billion in daily open interest and processes over $250 billion in daily trading volume. In just two months, Boros has achieved nearly $1 billion in notional trading volume and over $730,000 in annualized revenue, but even so, this only accounts for 0.03% of the pie.

In other words, this is a huge market with untapped potential: as the first protocol focused on funding rate trading, if Boros continues to grow and raises its share to 3% in the future, that would mean 100x growth potential.

Faced with the huge growth potential of this trillion-dollar track, Boros has already launched several core initiatives to embrace future growth.

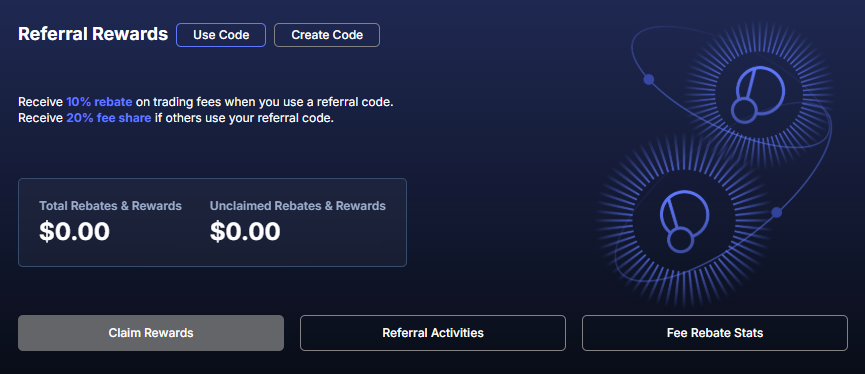

On one hand, after more than a month of improvement, testing, and trader observation, Boros officially launched Boros 1.0 and announced the start of the referral program, marking Boros' transition from the soft launch phase to full development. After the referral program is launched, new addresses with notional trading volume exceeding $100,000 can obtain a referral code. Referrers will receive 20% of the settlement fees and 20% of the trading fees generated by referred users, while referred users will enjoy a 10% discount on trading fees.

Each referral code is valid for one year. If the notional trading volume exceeds $1,000,000,000 during this period, the 10% discount will no longer apply.

**On the other hand, Boros will continue to optimize and improve in terms of functionality and products, supporting more assets, more trading platforms, and higher leverage efficiency in the future:** Boros currently supports BTC and ETH, and will gradually include more assets such as SOL and BNB in the future; Boros currently supports Binance and Hyperliquid, and will support more trading platforms such as Bybit and OKX in the future; in addition, as the market matures, higher leverage multiples will be supported, attracting more users to leverage higher returns at lower costs. Other additional measures include raising the OI cap and increasing vault quotas.

Beyond product optimization, Boros' scalable framework is even more noteworthy:

**In addition to funding rates, Boros' architecture can support any form of yield, including those from DeFi protocols, TradFi, as well as bonds, stocks, and other RWA assets.** This means that after devouring the giant market of funding rates, Boros will have the opportunity to expand into DeFi, CeFi, TradFi, and more dimensions.

This further aligns with Pendle's mission: "Where there is yield, there is Pendle." As Pendle's flagship product for 2025, in the foreseeable future, Pendle will use Boros as a medium to further cover both crypto finance and traditional financial markets, and, together with the in-depth advancement of the Citadels compliant PT plan, rapidly move towards the vision of an "all-in-one yield trading gateway."

Standing at the starting point of this devouring of all yield sources, with the continued development of Boros, we are witnessing the formation of a super yield platform that covers all types of yield and serves all user groups.

Deep Tide TechFlow is a community-driven in-depth content platform dedicated to providing valuable information and thoughtful perspectives.

Community:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin surges after US and China agree on key trade issues in Kuala Lumpur talks

US Treasury chief Bessent says 'substantial' trade framework with China reached

Chainlink (LINK) To Surge Higher? Key Harmonic Pattern Hints at Potential Upside Move

Ondo (ONDO) Following Potential Bullish Setup – Will It Rise Higher?