Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns

Today's Preview

- Ten wallets linked to the actual controller of Stable Vault deposited 500 million USDT ahead of the official announcement.

- The Humanity (H) token will unlock approx. 62.5 million tokens (about 3.01% of current circulating supply, valued at $7.3 million) at 08:00 on October 25, 2025.

- The Aspecta (ASP) token will unlock 1.54 million tokens (worth about $1.54 million, accounting for 9.13% of its market cap) at 20:00 on October 24, 2025.

Macro & Hot Topics

- Ethereum co-founder Vitalik Buterin announced at the ETHShanghai 2025 Summit that Ethereum has achieved real-time L1 block proofs, and will focus on significant privacy and scalability improvements.

- Solana ecosystem company Solmate Infrastructure (SLMT) unveiled a bare-metal node and data center initiative, receiving $300 million PIPE funding and $50 million in discounted SOL support. The stock surged 40%.

- The U.S. Senate held a closed-door meeting with crypto executives to discuss legislation on decentralized finance (DeFi) regulation.

- At the 223rd Ethereum ACDE meeting: Glamsterdam proposal deadline set for October 30th; Fusaka mainnet confirmed for launch on December 3rd.

Market Updates

1.BTC rebounded above $110,000 in the past 4 hours; ETH fluctuated above $3,800. Around $13.26 million in liquidations occurred in the last 4 hours, primarily short positions.

2.All three major U.S. stock indices closed higher: Dow up 0.31%, Nasdaq up 0.89%, S&P 500 up 0.58%.

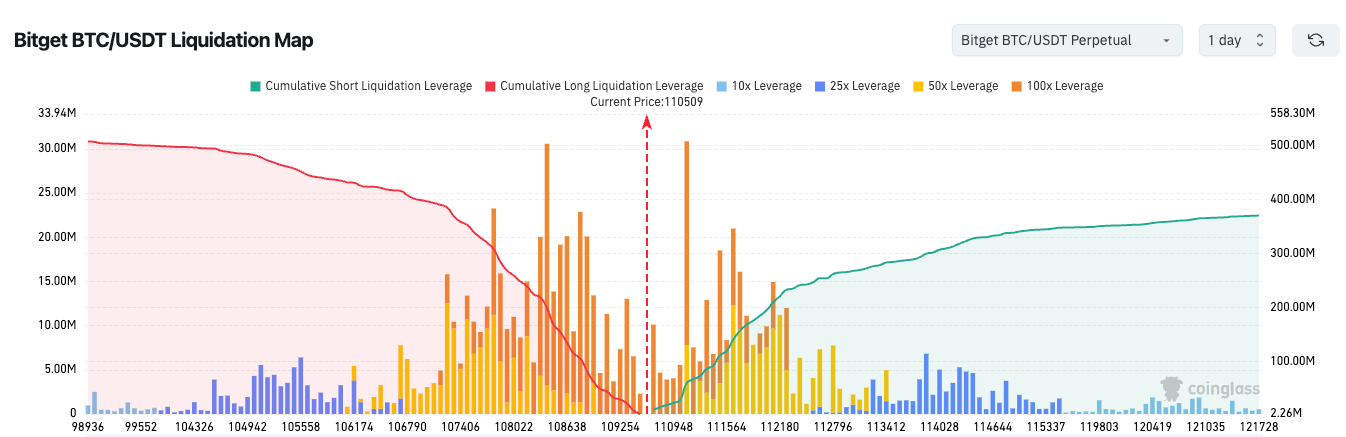

3.Bitget BTC/USDT Liquidation Heatmap: Current price at $110,490 with concentrated long/short liquidations, but short pressure is easing. A breakout could trigger major short stop-losses and potentially a short-term rally. Caution advised due to volatility.

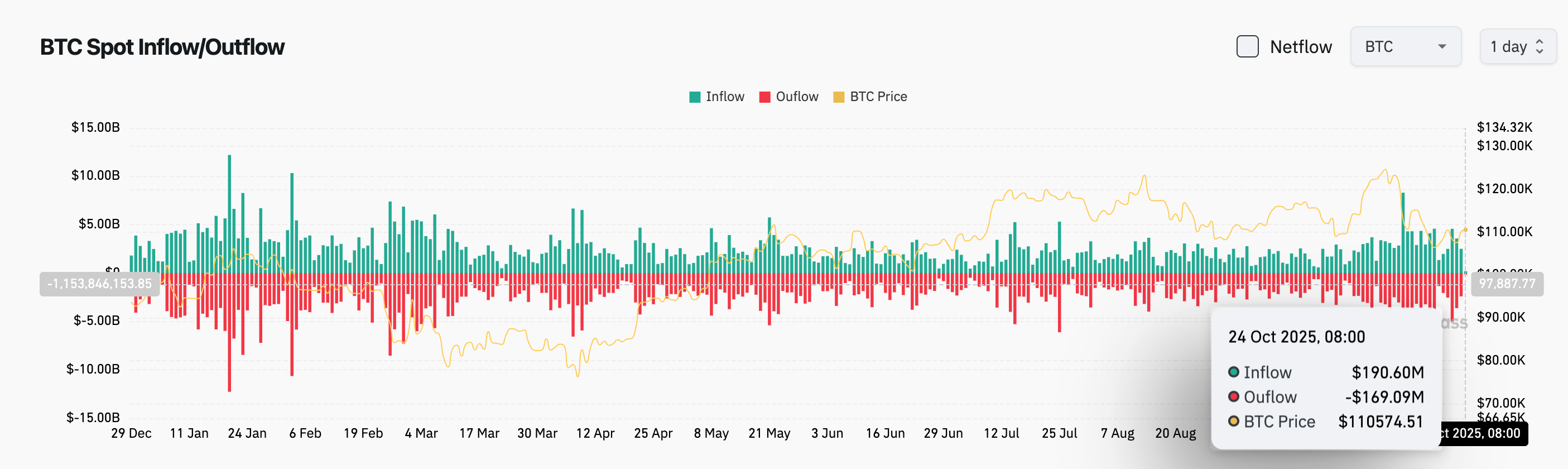

4.In the past 24 hours, BTC spot inflow was $190 million, outflow was $169 million, net inflow: $21 million.

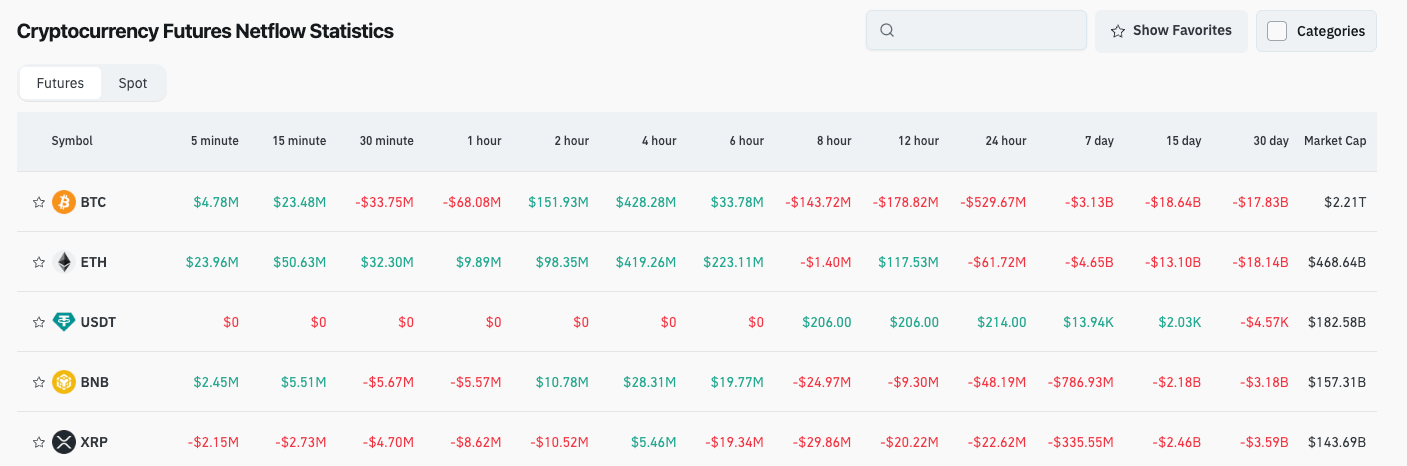

5.Over the past 24 hours, contract trading in BTC, ETH, USDT, BNB, XRP showed net outflows, indicating potential trading opportunities.

News Updates

- Blockchain.com obtained a MiCA license, enabling crypto services across all 30 European Economic Area countries.

- Proof company established a strategic partnership with Visa to introduce digital identity verification and crypto compliance tools.

- Russia's Ministry of Finance and Central Bank agreed to legalize cryptocurrency for international trade payments.

- Singapore launched the "BLOOM" initiative to develop AI + crypto-based Web3 financial infrastructure, promoting compliance and institutional adoption.

Project Developments

- Liechtenstein launched its sovereign blockchain: Liechtenstein Trust Integrity Network (LTIN).

- Kinetiq Foundation announced the launch of its governance token KNTQ, with TVL exceeding $1.6 billion.

- Clanker has joined the Farcaster ecosystem and initiated $CLANKER buyback and deflationary measures.

- Bitget CandyBomb launches a new project, CGN, with a 1 million CGN prize pool.

- An early UNI investor transferred another 2.5 million UNI to Wintermute, possibly indicating further token sell-offs.

- Cathie Wood disclosed an investment in Japanese Ethereum treasury company Quantum Solutions.

- Fireblocks completed the acquisition of Web3 ID solution company Dynamic, expanding on-chain developer tools.

- Tether made a strategic investment in African fintech platform Kotani Pay to support Web3 payments and cross-border expansion.

- The first phase of Stable’s advance deposit campaign quickly hit the $825 million cap, sparking community allegations of insider activity ("front-running").

Disclaimer: This report is AI-generated, with information verified by humans. This does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stable closes initial pre-deposit phase after reaching US$825 million

JPMorgan will allow the use of Bitcoin and Ether as loan collateral

Solana Attracts Institutions with $700 Million in Real Assets and Zero Failures

JustLend DAO starts burning 560 million JST