Is USDe really safe enough?

USDe withstood the test during a record-breaking liquidation day in October, and remains safe unless multiple "black swan events" occur simultaneously.

USDe withstood the test during the record liquidation day in October, and unless multiple "black swan events" occur simultaneously, USDe remains safe.

Written by: The Smart Ape

Translated by: AididiaoJP, Foresight News

More and more people are beginning to worry about whether USDe is truly safe, especially after the recent depegging incident.

The depegging triggered a lot of FUD, making it difficult to stay objective. The goal of this article is to examine @ethena_labs clearly and factually. Once you have all the information, you can form your own opinion, rather than following those who may be biased or have hidden interests.

USDe Depegging

On the night of October 10, USDe experienced a severe depegging. When I saw it drop to $0.65, I panicked myself.

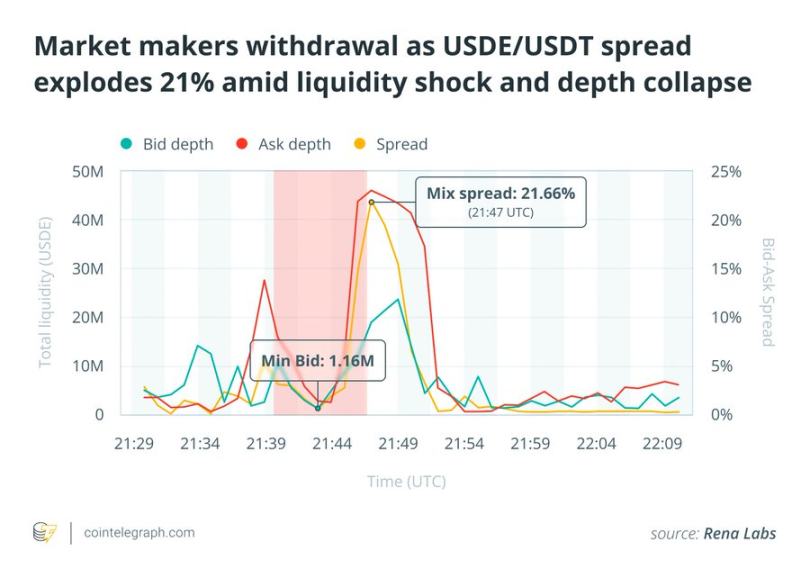

But the depegging only happened on @binance. On venues with deeper liquidity like Curve and Bybit, USDe barely fluctuated for long, bottoming out around $0.93 and recovering quickly.

Why Binance?

Because Binance allows users to use USDe as collateral and evaluates the value of this collateral using its own internal order book (rather than an external oracle).

Some traders exploited this flaw, dumping $60 million to $90 million worth of USDe, pushing the local price down to $0.65 and triggering $500 million to $1.1 billions in forced liquidations, as these assets were used as margin.

In short, the issue was unrelated to Ethena's fundamentals, but rather to Binance's design. If an oracle-based price feedback mechanism had been used, this could have been avoided.

Will USDe Collapse Like UST?

Many people compare Luna or UST to Ethena, but fundamentally, they are two completely different systems.

First, Luna had no real revenue, but Ethena does. It earns yield through liquid staking and perpetual funding rates.

Luna's UST was backed by its own token $LUNA, which meant it was essentially unbacked. When LUNA collapsed, UST collapsed as well.

Ethena is backed by delta-neutral positions, not by ENA or any token related to Ethena.

Unlike Anchor's fixed 20% APY, Ethena does not guarantee any yield; it rises and falls with the market.

Finally, Luna's growth was unlimited, with no mechanism to slow expansion. Ethena's growth is limited by the total open interest on exchanges. The larger it gets, the lower the yield, which keeps its scale balanced.

So, Ethena and Luna are completely different. Ethena could fail, like any protocol, but it will not fail for the reasons Luna did.

What Are Ethena's Risks?

Every stablecoin carries risks, even USDT and USDC have their own weaknesses. It's important to understand what these risks are and how severe you think they might be.

Ethena relies on a delta-neutral strategy:

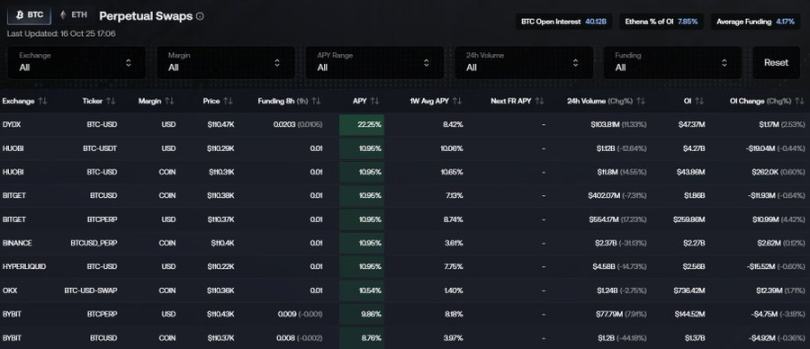

- Long positions (BTC, ETH) established through liquid staking or lending protocols,

- And short positions established through perpetual contracts on centralized exchanges.

To me, the biggest risk is if major exchanges (Binance, Bybit, OKX, Bitget) collapse or freeze withdrawals, Ethena will lose its hedge, resulting in instant depegging.

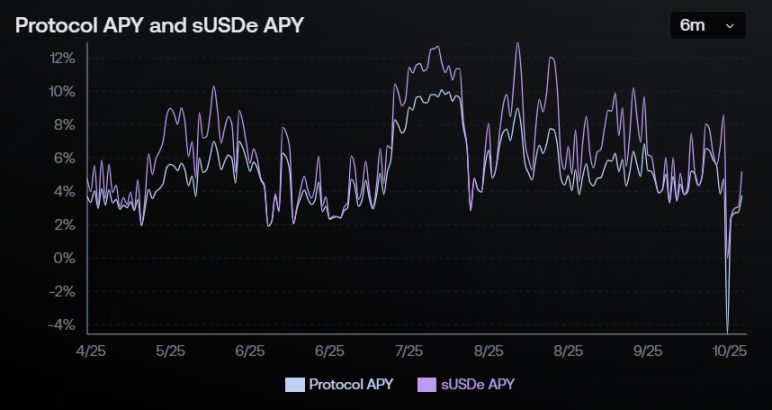

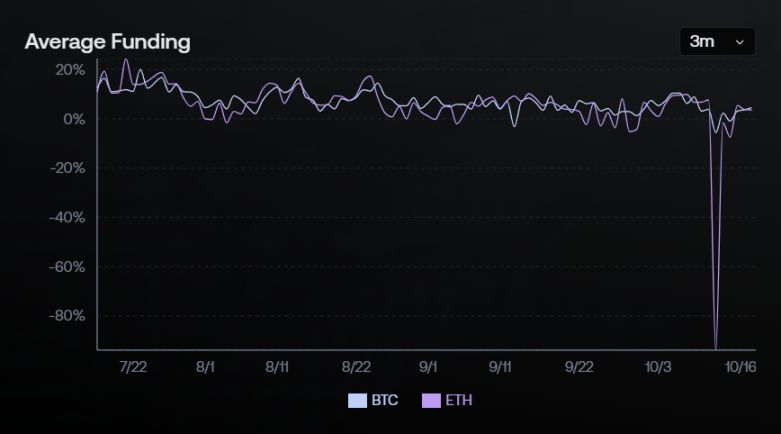

There is also funding rate risk. If funding rates are negative for a long period, Ethena will consume capital instead of earning yield. Historically, funding rates have been positive over 90% of the time, which can offset brief negative periods.

USDe also undergoes rebasing. When the protocol earns yield, new tokens are minted. If the market turns and collateral value drops, this could cause slight dilution. So over time, this could lead to slight undercollateralization.

Ethena also operates in a highly leveraged ecosystem. A large-scale deleveraging event (like the cascading liquidations on October 10) could disrupt hedges or force liquidations.

Finally, all of Ethena's perpetual short positions are denominated in USDT, not USDe. If USDT depegs, USDe will also depeg. Ideally, perpetual contracts should be denominated in USDe, but convincing Binance to change the BTC/USDT pair to BTC/USDe seems impossible to me.

These are the main risks currently debated around Ethena.

Risk Assessment

The list above may sound scary, but the probability of these events happening simultaneously is extremely low. You would need a long-term negative funding rate environment, exchanges collapsing at the same time, and a complete freeze of liquidity, which is statistically unlikely.

You can think of it like rolling dice: the probability of rolling a "1" is one in six, but rolling a "1" and then a "2" consecutively is one in thirty-six. That's how combined probability works here.

Ethena was built after the Terra and FTX incidents, learning from those lessons. It has a reserve fund, off-chain custody, floating yields, and is integrating oracle-based pricing.

In reality, the most likely outcome is not a collapse, but occasional peg fluctuations during periods of market stress, as we saw on Binance, but without triggering broader contagion. Even if a severe event occurs, it would affect the entire perpetual and synthetic stablecoin market, not just USDe.

Remember, Ethena has already survived the largest liquidation event in crypto history without losing its peg, passing a real stress test.

Its collateral is on-chain and transparent, unlike many "mystery basket" stablecoins backed by obscure off-chain reserves of altcoins.

Frankly, there are many stablecoins in circulation today that are much riskier than Ethena; we just hold Ethena to a higher standard because of its scale and visibility.

My Personal View

Personally, I don't think USDe faces significant depegging risk; it would take multiple disasters happening at once to cause that. And if it did happen, it wouldn't fall alone.

There are currently stablecoins on the market with much higher risk that still hold huge market caps.

If USDe survived the record liquidation day in October unscathed, that speaks volumes about its resilience.

So, I don't think Ethena is particularly dangerous, certainly not more dangerous than other stablecoins.

They are also one of the few projects innovating in the stablecoin space, and based on current results, this innovation is effective.

As always, don't put all your eggs in one basket. Diversify your stablecoin exposure, stay informed, and relax.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet introduces multichain gas abstraction for simpler crypto transactions

Ethereum fails again above $4K as traders grow frustrated with shakeouts

Will Solana price bounce below $180? Double bottom hints at 40% rally

The Eye of the Crypto Storm: Hyperliquid—No Board of Directors, No Investors, the "Leverage Tool"

The decentralized exchange Hyperliquid, operated by only 11 people, has become a major force in the crypto world with daily trading volumes exceeding $13 billion, thanks to its anonymity and high leverage.