Bitcoin’s recent price surge toward $115,000 has reignited debate among analysts, with several warning that the market could be setting up for a sharp reversal similar to Japan’s historic carry trade crash.

While bullish momentum remains intact for now, on-chain data suggests the rally may be approaching a critical inflection point.

Parallels With Japan’s Carry Trade Crash

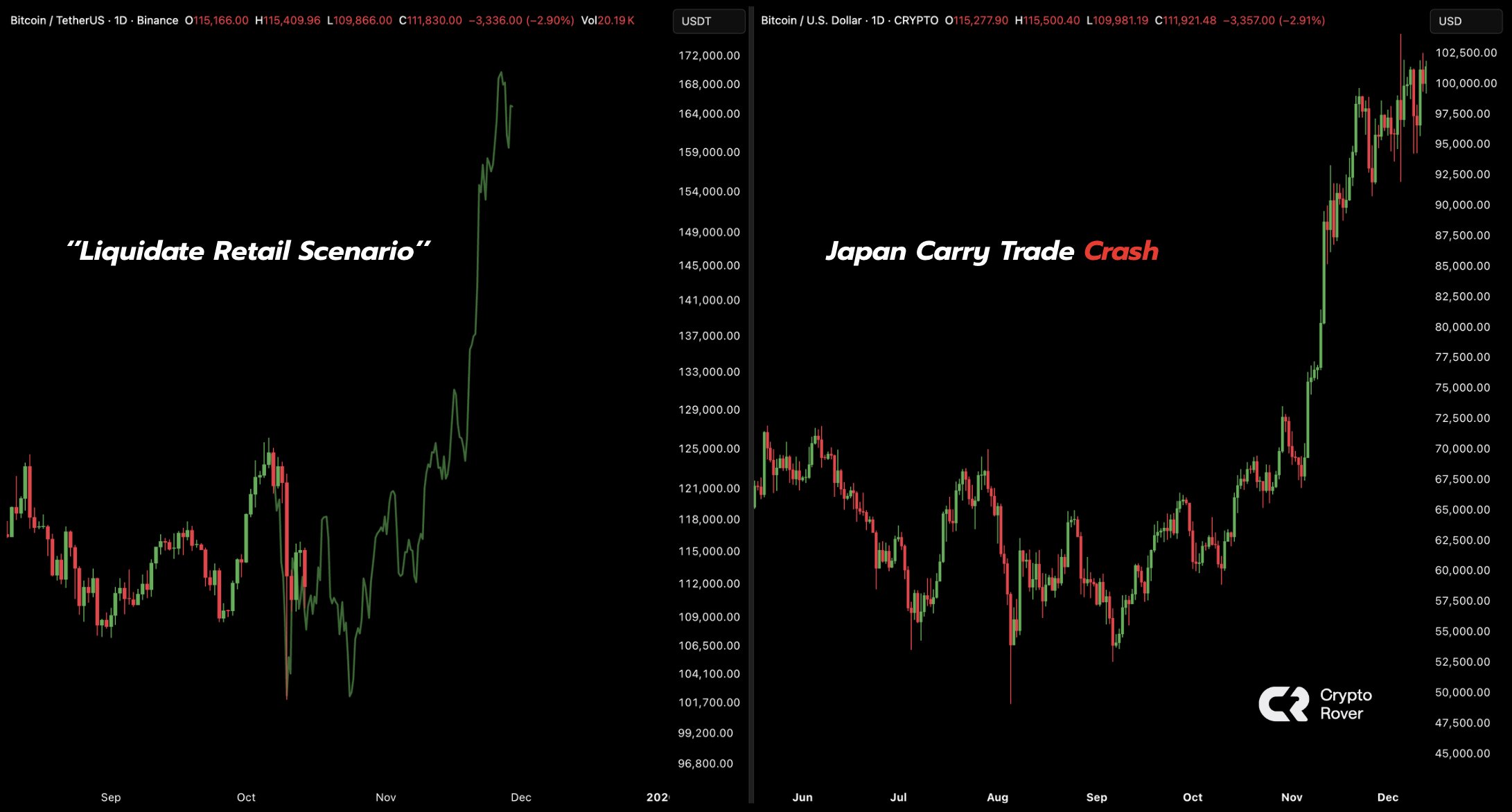

Crypto analyst Crypto Rover compared Bitcoin’s current market structure to Japan’s carry trade meltdown, where leveraged positions unwound violently, wiping out many traders. He described the ongoing setup as a potential “Liquidate Retail Scenario,” implying that Bitcoin could soon trigger a cascade of retail liquidations if prices break lower.

Charts shared by Rover reveal how Bitcoin’s steep advance resembles the pre-crash patterns seen in the carry trade episode. The scenario highlights a typical trap where a parabolic rise draws in retail traders before a sharp correction forces them out of the market.

Fading Demand Signals Emerging

In a separate analysis, Rover highlighted that Bitcoin’s apparent demand is weakening. Data from CryptoQuant shows that each major “spike” in demand, followed by a decline, has historically preceded cycle tops or large pullbacks. The most recent data shows fading positive demand, which could indicate that buyers are losing momentum.

Such fading demand has often coincided with overheated market sentiment. If the trend continues, it could signal that the current rally is entering its exhaustion phase — especially if retail participation remains high.

Glassnode Data Warns of a Correction Zone

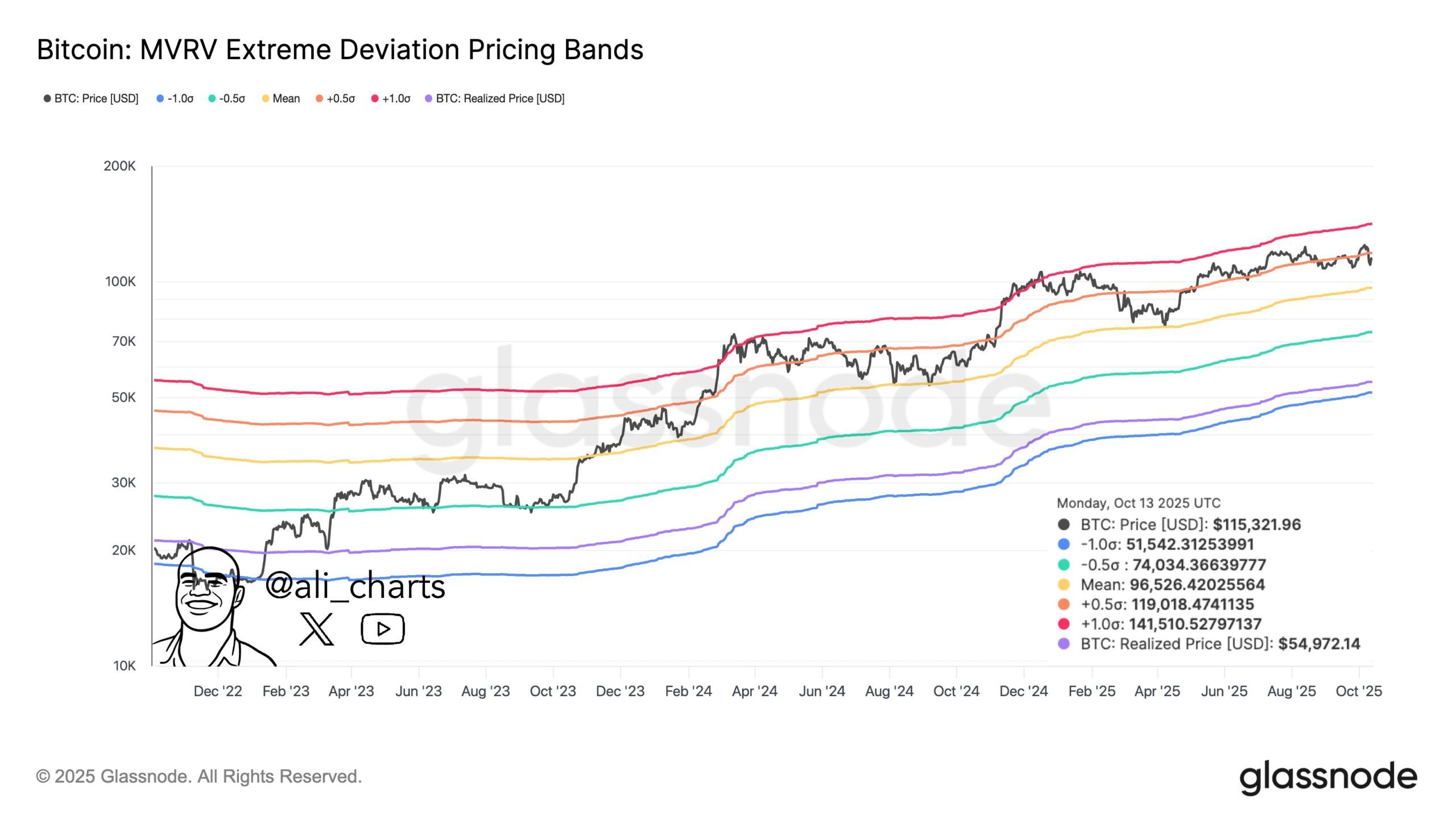

Supporting these concerns, Glassnode analyst Ali shared a chart showing Bitcoin’s MVRV deviation pricing bands. According to him, Bitcoin must reclaim $119,000 to keep the bullish narrative alive. Failure to hold above this level could open a path for a correction toward the $96,530 region — aligning with the model’s mean price band.

Ali emphasized that the $119,000 threshold serves as a key momentum line. A sustained recovery above it could set the stage for a new push toward $141,000, while rejection may confirm a short-term correction phase.

Market at a Crossroads

For now, Bitcoin remains in a delicate position — with traders watching whether the $115,000 support can hold or if a breakdown triggers cascading liquidations. Historical patterns suggest that fading demand and high retail leverage often precede volatility spikes, meaning the next move could determine whether the current uptrend continues or stalls into a deeper retracement.