10·11 Self-Reflection After the Crash: Why I Still Can't Leave the Crypto Game

The author reviews four years of dedicated experience in the cryptocurrency field, shares survival strategies during the 10.11 market crash, discusses the risks of leveraged trading and the current state of the industry, and reflects on investment mindset and future direction. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively updated.

I've been reflecting a lot on my life choices recently — for the past four years, I've devoted myself almost entirely to the cryptocurrency field, and "entirely" is no exaggeration: I have almost no other hobbies, and most of my waking hours are directly or indirectly centered around crypto: researching trading, testing new protocols, communicating with others, posting content on X, reading others' opinions, browsing industry newsletters, and reading podcast transcripts (I prefer text because I can read five times faster than watching videos or listening to audio).

I genuinely love the process of working hard, and I might even say I'm a bit obsessed. This doesn't mean crypto is my only interest, but it is indeed my core focus at the moment. Maybe one day in the future I'll get bored, and then I might spend weeks or months thinking about my life's direction before finding a new goal. But looking back, my obsession with numbers and speculation is quite obvious.

The "10.11" crash was shocking, but I was almost unscathed. Over the weekend, I used a delta-neutral strategy on the Lighter platform, and my short positions weren't automatically liquidated as they would have been on platforms like Hyperliquid; as for my long positions, I only held spot assets. At the time, I didn't have any perpetual contract positions open on Bybit, and the day before the crash, I closed a sizable DOGE/BTC pair trade — my intention was just to have a peaceful weekend, but in hindsight, if I hadn't closed that trade, I probably would have suffered heavy losses. So surviving this time was indeed partly due to luck.

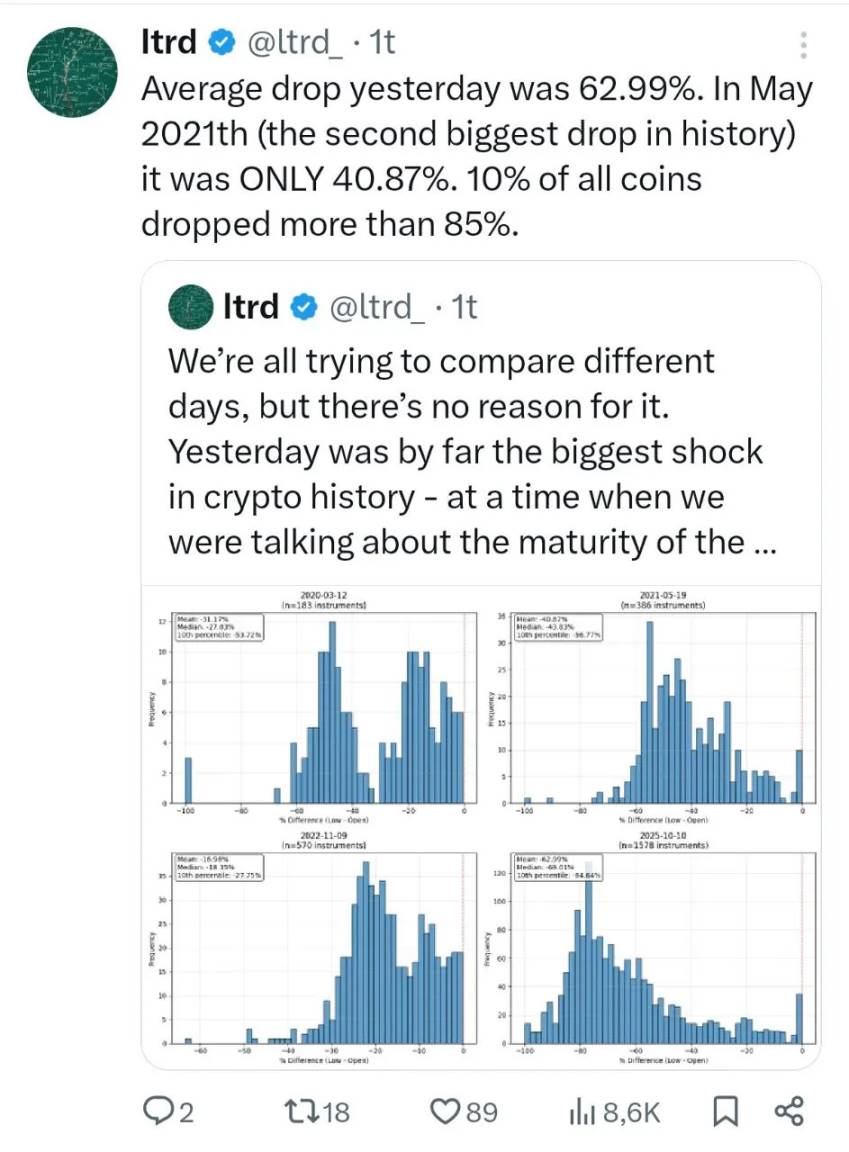

I usually use low leverage of 2-3x in my daily trading, mainly to reduce the margin required on centralized exchanges (CEX) or decentralized exchanges (DEX). But this crash still shocked me: the average drop for altcoins was 62%, with some coins plunging 85%-99% — which means all leveraged long traders were "liquidated." In the past few years, many aggressive traders (known as "degens" in the community) have flooded into the crypto trading market, first battling it out in the Solana ecosystem, then moving into perpetual contracts. Now, leveraged trading has become the industry norm, and I myself use leverage every day. Some might criticize these traders for lacking risk management, but in my view, 2-3x leverage is actually quite conservative. And to be honest, I don't think people will give up leverage because of this crash — in just 1-2 weeks, those aggressive traders will be back in the market as if nothing happened.

Just imagine, facing an average 63% drop in altcoins (and that's just the average — most coins fell much more), how would you hedge your risk? It's just insane.

So, after experiencing this crash, who will stay and continue to "fight" in this cycle?

The answer is those who are "stubborn yet cautious": they mainly hold spot assets and will observe new coins or projects for a long time before getting involved. They don't blindly follow the crowd and go all-in, so they usually can't achieve ultra-high returns, but at the same time, their portfolios can achieve stable compound growth year after year.

The most severely impacted were perpetual contract traders; ironically, many "altcoin diehards" (such as traders in the Solana ecosystem) were actually in a relatively better position — because most of them trade without leverage. Of course, some of them did get involved in the perpetual contract market, and if so, they most likely suffered heavy losses. But most still stick to "spot positions," so even if they lost money, it wasn't a total wipeout.

For perpetual decentralized exchanges (Perp DEX), the impact of this crash is worth noting: on Hyperliquid, short positions were automatically liquidated, resulting in profits for its platform token HLP; while on Lighter, short positions were not liquidated, causing losses for its platform token LLP. No one can predict the future of perpetual DEXs, but this "10.11" "stress test" has left the industry with many lessons and areas for improvement. For example, does the HYPE token buyback model need adjustment? Is 100% buyback sustainable?

Will I stop using leverage? The answer is no. I know I need to take responsibility for all my trades and decisions, and risk is always present — if there were no risk, there would be no returns.

As for the DeFi sector, I expect a wave of position liquidations in the future. Although DeFi performed well in this "10.11" crash, market panic has spread, and many people may prefer to keep their assets in their own wallets rather than entrust them to third parties. Fortunately, USDe remained stable during this event. In my view, Ethena is truly the "pillar" of the DeFi sector — it supports the entire DeFi ecosystem, and if Ethena encounters problems, it will trigger a chain reaction (for example, 70% of Pendle's total value locked (TVL) relies on Ethena).

Looking ahead, I've been thinking about which altcoins are worth buying. At the moment, I'm more inclined towards MNT and those long-standing "veteran tokens." In addition, I think the future "altcoin speculation frenzy" will cool down, so PUMP and Fartcoin won't be my main investment targets. Currently, I mainly hold stablecoins and plan to adopt a "pure news/narrative-driven" trading model — this approach may not bring the highest returns, but at least it can protect my account funds well in the short term.

Finally, I want to say:

Most people can't achieve their dream wealth goals because they don't possess the qualities of a successful person.

Your competitors are those who are "born for this field": they don't care about working hours and don't back down when facing difficulties. They don't slack off in good times, and they don't give up in adversity — this has long become their way of life.

Wealth may be their apparent goal, but what truly drives them is "the pursuit," "the joy of growth," "the honing of skills," and the quiet improvement of their professional abilities when no one is watching.

They are not obsessed with the "finish line," but deeply love "the scenery along the way."

That's why, when others choose to get tired or quit, they can continue to "win" — not because they "must win," but because they can't imagine leaving the "game" they love.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Recall Network(RECALL)

HYPE Trader Targets $50 After Fresh Entry Setup at $37 Range

Dogecoin Holds Above $0.1973 Support as Weekly Triangle Pattern Persists