Cross-chain protocol LayerZero has announced the acquisition of multichain bridge Stargate Finance for $120 million worth of ZRO tokens. Stargate Finance DAO approved the deal with an overwhelming majority.

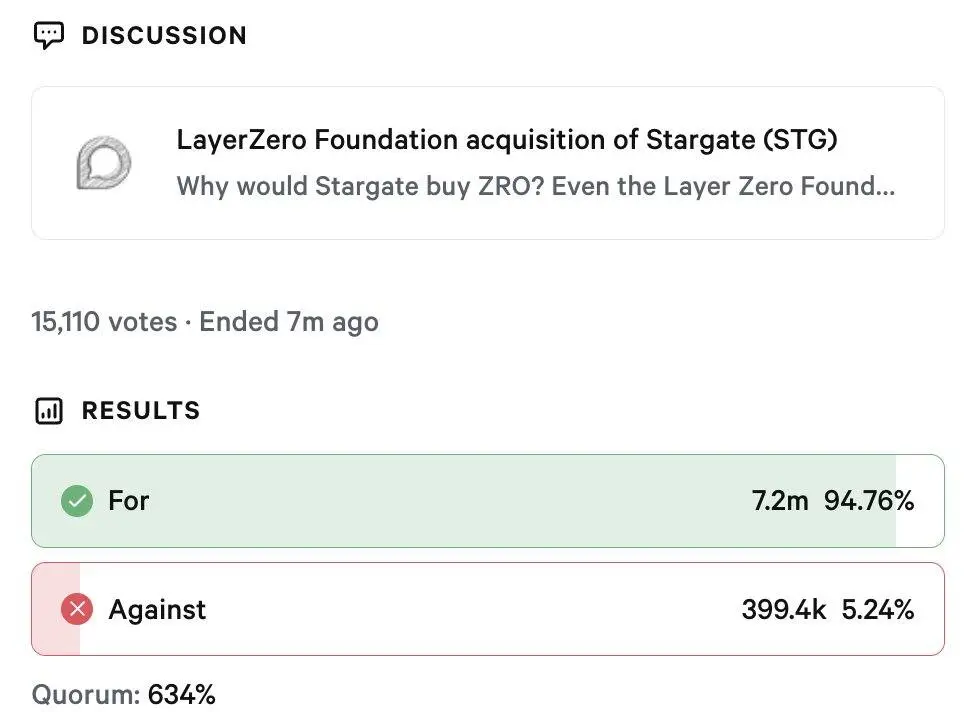

The acquisition will see LayerZero and Stargate merge under one project, with ZRO becoming the official token for the two cross-chain protocols. 94% of Stargate Finance DAO approved the deal.

The merger between marks a reunion of the two projects. Stargate Finance was created by the LayerZero team in 2021 but eventually spun out as a decentralized autonomous organization (DAO).

The majority of Stargate DAO supported the LayerZero acquisition. Source: Stargate DAO

The majority of Stargate DAO supported the LayerZero acquisition. Source: Stargate DAO

Since then, Stargate has become one of the biggest multichain bridges in the crypto ecosystem, connecting around 50 blockchain networks and powering more than $70 billion in transactions.

Per the press release, the deal represents a milestone as this is one of the first times that a DAO has been acquired at over $100 million. The deal almost did not happen with cross-chain bridge Wormhole making a late effort to hijack the acquisition.

Wormhole Foundation claimed that the LayerZero offer for Stargate Finance was not compelling and undervalued the protocol business, adding that it was willing to submit a higher bid than the initial $110 million from LayerZero.

The challenge led to LayerZero revising its offer, while Wormhole also asked for a vote pause of five business days to finalize its offer and get more insight into Stargate’s financials. There were further rumors that Across Protocol and Axelar showed interest in Stargate.

However, most Stargate DAO members supported the LayerZero revised bid, which not only increased the bid’s value but also offered other incentives, including a revenue-sharing period for those who staked Stargate STG tokens.

Deal to strengthen LayerZero dominance in the cross-chain ecosystem

Meanwhile, the deal will further cement LayerZero’s position in the blockchain interoperability ecosystem. Data from Token Terminal shows that it has already controlled around 85% of the market share over the past 12 months, and several companies, including PayPal , BitGo, and Paxos, are using its services.

With the deal, which will unite Stargate DAO and LayerZero under one umbrella, the cross-chain protocol now looks to expand further and strengthen its ecosystem. This move will further bring more value to the LayerZero community.

Speaking on the deal, LayerZero Labs CEO Bryan Pellegrino stated that the team has been working on the infrastructure to enable cross-chain interoperability for years and Stargate’s return to help improve its services.

He said:

“Stargate’s return gives the LayerZero ecosystem a clear access point to the end-consumer, an immediate revenue-generating asset, and a clear focus on accelerating the velocity of value transfer.”

Meanwhile, the deal now means Stargate DAO will be dissolved with STG tokens swapped for ZRO at a ratio of 1 STG to 0.08634 ZRO. The revenue generated from Stargate will also go towards the ZRO buyback.

ZRO token down despite positive news

Despite the positive development many in the LayerZero and Stargate community have welcomed, the ZRO token is down slightly in the last 24 hours. Its decline appears to be part of the broader drop across the crypto market, with major cap tokens such as Bitcoin and XRP also declining.

However, ZRO’s decline is more pronounced given how it has struggled this year in general. It has been down 7.52% in the last seven days while it has lost 26% in three months. At $2.032, the token has already lost more than 61% of its value this year.

Interestingly, STG is not doing much better. The token, which is trading at $0.1769, is down by 2% in the past seven days while losing more than 50% of its value year-to-date. Holders of both tokens will be hoping to see a resurgence in value for ZRO now that they are united under one ecosystem.

If you're reading this, you’re already ahead. Stay there with our newsletter .