Bitcoin chain indicator analysis: the nine-finger cap chart suggests that the bull market is still accumulating strength

CryptoChan2025/01/04 03:20

By:CryptoChan

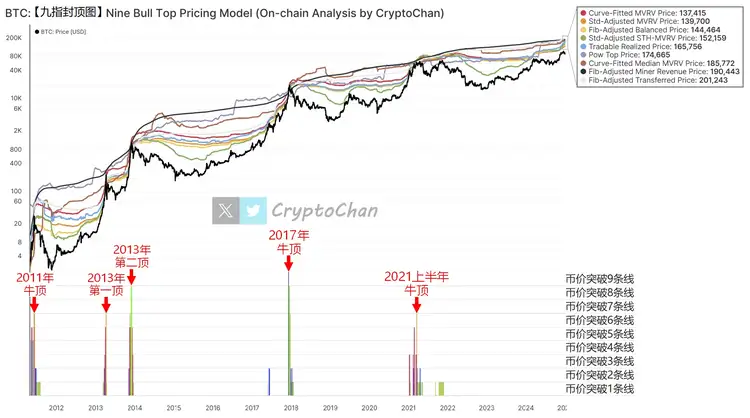

CryptoChan, an on-chain analyst, has updated the Bitcoin "nine-finger cap chart" as an important reference for the market. Historical data shows that each bull market peak will break through multiple key lines, indicating the extreme overvaluation of the market. However, as of now, the

Bitcoin price has not broken through any key reference line, indicating that the bull market has not yet truly started.

Historical Review: Breakthrough at Key Vertices

- 2011 bull market peak: Bitcoin price breaks through 6 reference lines.

- The first peak in 2013: Bitcoin price broke through six reference lines.

- The second peak in 2013: Bitcoin price broke through 8 reference lines.

- 2017 bull market peak: Bitcoin price breaks through 9 reference lines, reaching the chart limit.

- The bull market peak in the first half of 2021: Bitcoin price broke through 6 reference lines again.

Current on-chain reference price (by color)

- 🔴 Curve-Fitted MVRV Price: $137,415

- 🟠 Std-Adjusted MVRV Price: $139,700

- 🟡 Fib-Adjusted Balanced Price: $144,464

- 🟢 Std-Adjusted STH-MVRV Price: $152,159

- 🔵 Tradable Realized Price: $165,756

- 🟣 Pow Top Price: $174,665

- 🟤 Curve-Fitted Median MVRV Price: $185,772

- ⚫ Fib-Adjusted Miner Revenue Price: $190,443

- ⚪️ Fib-Adjusted Transferred Price: $201,243

Currently, the price of Bitcoin has not broken through any reference line and is in a relatively undervalued state. Combined with historical performance, this may mean that the market is still in the stage of accumulating strength and has not yet entered the overheated area of the bull market peak. Investors should pay attention to whether the price gradually breaks through the key reference line, as well as changes in the macro environment and on-chain data, which will provide more basis for judging the potential opening of the bull market. From the on-chain perspective, the market still has significant upward space, but short-term volatility risks need to be vigilant.

6

13

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Cointribune•2025/11/30 11:03

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Cointribune•2025/11/30 11:03

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

Coinpedia•2025/11/30 03:39